6 reasons why it is not easy for Vietnam to surpass India to receive capital from China

In April 2020, the Japanese government announced a $2.2 billion stimulus package to help manufacturers move production out of China. South Korean and U.S. companies are also looking for alternative manufacturing facilities.

Over the past two decades, China has served as a global manufacturing hub for companies in a variety of industries, such as electronics, textiles, medical devices, and automobiles. The main factors are the high availability of raw materials, technological innovation, business-friendly laws, and access to skilled labor.

However, the scenario changed in 2019. Rising labor costs, as well as tensions created by the U.S.-China trade war, have shaken China's role as a manufacturing hub. More than 50 multinational companies have decided to shift production (partially or completely) to other low-cost destinations, such as India, Vietnam, Thailand and other Southeast Asian countries, to avoid tax increases in 2019.

The Covid-19 pandemic has exacerbated that situation. Manufacturing companies worldwide are increasingly focused on reducing their supply chain dependence on China.

In April 2020, the Japanese government announced a $2.2 billion economic stimulus package to help manufacturers move production out of China. South Korean and U.S. companies are also looking alternative production facilities.

Some manufacturing companies are considering moving production facilities to other low-cost Asian countries, mainly India and Vietnam. And here are the reasons why Vietnam must really make an effort if it wants to surpass India in this race.

Availability of port infrastructure

According to the World Economic Forum, India ranks 51st out of 139 countries in the Port Infrastructure Index. Vietnam holds the 85th position.

For Vietnam, the geographical location is also very suitable, facilitating connections with other countries, making it a suitable center for production. Forty-four major seaports are located on the 3,260 km long coastline, manage ~400 pcs 500 million tons of goods annually; however, this is significantly lower than India. In addition, the cost of shipping from Vietnam to the US, South Korea, and Japan is higher (50 50100%) than India. These factors make it a less favorable destination.

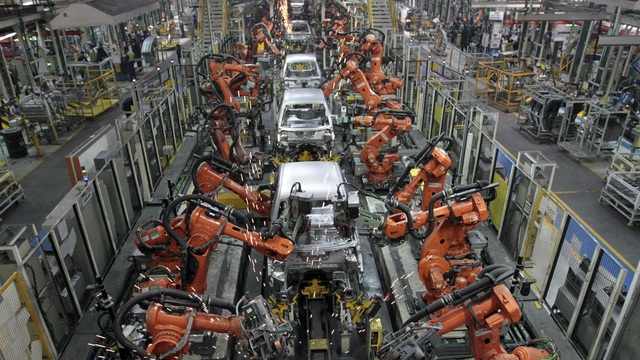

Adoption of technology and automation

India ranks 18th and Vietnam ranks 24th in the Automation Readiness Index. In addition, India's total R&D spending, as a percentage of GDP, is almost double that of Vietnam.

The Indian government is still working to prepare a blueprint to speed up the transformation of digital manufacturing. Many organizations have taken steps in this regard and invested in the establishment of the Elite Industry Center 4.0.

Bosch Rexroth, a leading provider of customized automation technology solutions, has sponsored India's first Automation Technology Centre at Gujarat Technology (GTU), while other companies such as Siemens are investing in R&D related to digitalization technology at the plant.

Tax Rate

In 2019, India reduced the general corporate tax rate to 22% from 30% to boost investment, attract international companies, and strengthen the country's economy. In addition, for new manufacturing companies planning to come to India, The corporate tax rate has been reduced to 15% (17%, including surcharges) from 25%. Vietnam currently has a tax rate of 20%.

Price and availability of labor costs

India has a workforce of more than 500 million people, with about 5-10 million workers added each year. The other monthly production wage is about 110-130 USD. Vietnam has about 57.5 million workers, with an average salary ranging from 130-190 USD per month.

Domestic market size

India is a much larger market than Vietnam, leading to better prospects for investors. In 2019, India's consumer electronics market stood at $11 billion, while Vietnam was about $6-7 billion. Nearly 3.8 million new cars (passenger cars and commercial vehicles) and 159 million mobile phones were sold in India in 2019, compared to 0.3 million and 20 million in Vietnam.

Availability of raw materials

Vietnamese manufacturers still rely on importing components and raw materials to produce goods. The majority of raw materials are sourced from outside. In fact, 70% of steel raw materials and 80% of textile raw materials, 75% of plastic raw materials and 80% of electronic components, 90% of pharmaceutical raw materials come from China, due to the close geographical location.

India's raw material production capacity, on the other hand, is relatively strong. Also, it is the largest cotton producer and the second-largest steel producer globally.

Vietnam is really emerging as a good candidate to receive large capital flows from China and has been doing relatively well in doing so. But the road ahead is still very long and there are many factors that need to be improved.

According to Dan Sinh Newspaper/The Economic Times

Related News

Foxconn pours $1.5 billion into Thanh Hoa to produce for Apple

14/2/2021

We have generated more than $1,200 billion in GDP

11/11/2020

Vietnam's economic growth forecast for the 4th quarter of 2020 and 2021: Will recover in a V-shape, in 2021 it will increase by about 6.5 - 7%

21/10/2020

Standard Chartered: Vietnam's GDP growth forecast of 3% in 2020 and 7.8% in 2021

20/10/2020

Samsung's outstanding moves in Vietnam and other countries in the "year of Covid-19"

20/10/2020

Featured Articles

Miza Group donated 3 billion VND in response to the contest movement "The whole country joins hands to remove temporary houses and dilapidated houses" in Thanh Hoa

7/6/2025

MIZA GROUP ENTERS THE TOP 10 GREEN VIETNAM ESG 2025 THANKS TO THE CIRCULAR ECONOMY DEVELOPMENT STRATEGY

27/6/2025

Miza (MZG) shares are officially listed on UPCoM

12/11/2024