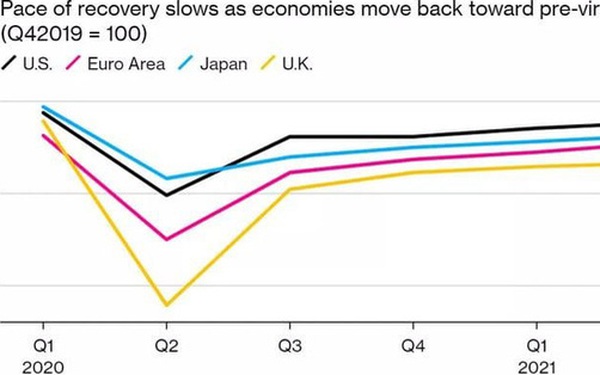

Global economic recovery slows down

About $20 trillion is stimulated from governments and central banks to help countries return to a stable state after the pandemic. But for many reasons, the world economy is facing the most difficult period:

Ethan Harris (Bank of America Corp.) said: "We are recovering from the shutdown but now we are going deeper into another phase of crisis."

All the risks since the pandemic have made investors less optimistic than in the early stages of the epidemic. The S&P 500 (a stock index based on the market capitalization of 500 publicly traded companies in the U.S.) fell sharply in September after five consecutive gains; Europe's Stoxx 600 also faces this decline.

Governments have subsidized income – helping companies stay afloat, while central banks have cut interest rates and ensured that financial markets remain liquid. Deutsche Bank AG warned of a 5.9% decline in global GDP this year, but now the decline has been limited to 3.9%.

Back in crisis?

Despite support from the government, this is also the deepest decline in many years.

According to JPMorgan Chase & Co., fiscal stimulus helped add 3.7 percentage points to global GDP this year, but commercial banks expect policymakers to repeat the mistakes made after the crisis financial panic in 2008 and turned to "austerity". They also implemented tight lending policies.

Hopes for a V-shaped recovery are fading with the rapid spread of Covid-19, so governments are reluctant to return to a complete lockdown.

With revenues tightened, businesses could struggle to repay their debts – leading to more bankruptcies and causing lenders to tighten their grip on granting credit even to feasible projects. Along with the social distancing regime that lasts longer, the more companies decide to reduce production demand for goods and services, leading to a shrinking workforce.

What do Bloomberg economists say?

Depleted financial resources in the US and the fact that a vaccine has not yet been found has created an uncertain recovery outlook for the global economy (Tom Orlik – Bloomberg chief economist).

On September 30, 2020, Disney announced plans to cut 28,000 workers, Shell said it could cut 9,000; Germany's Continental AG has approved a plan to eliminate 30,000 jobs worldwide (Bloomberg). And the recovery in the labor market is also slowing down. In the US, the number of applications for unemployment benefits increased 4 times compared to 2019.

In Europe, manufacturing growth in September, the fastest pace in more than two years, was not enough to prevent continued job losses. According to HIS Markit, companies are only focusing on solving costs due to the "uncertain short-term outlook".

However, Tom Orlik said that political instability in Europe, the election campaign in the United States and the still-simmering US-China trade war are also the reasons for the slow recovery of the economy.

Besides, there are still a handful of countries that are showing encouraging signs of recovery from the pandemic – especially China and some other Asian countries with small economies. The world's second-largest economy is trying to control the pandemic and achieve a fast recovery.

~According to Toquoc.vn~

Related News

Foxconn pours $1.5 billion into Thanh Hoa to produce for Apple

14/2/2021

We have generated more than $1,200 billion in GDP

11/11/2020

Vietnam's economic growth forecast for the 4th quarter of 2020 and 2021: Will recover in a V-shape, in 2021 it will increase by about 6.5 - 7%

21/10/2020

Standard Chartered: Vietnam's GDP growth forecast of 3% in 2020 and 7.8% in 2021

20/10/2020

Samsung's outstanding moves in Vietnam and other countries in the "year of Covid-19"

20/10/2020

Featured Articles

Miza Group donated 3 billion VND in response to the contest movement "The whole country joins hands to remove temporary houses and dilapidated houses" in Thanh Hoa

7/6/2025

MIZA GROUP ENTERS THE TOP 10 GREEN VIETNAM ESG 2025 THANKS TO THE CIRCULAR ECONOMY DEVELOPMENT STRATEGY

27/6/2025

Miza (MZG) shares are officially listed on UPCoM

12/11/2024