How does the escalation of US-China trade tensions affect the Vietnamese economy and financial markets and the world?

TS. Can Van Luc and the authors of the BIDV Institute of Training and Research have just released a quick report on the escalating trade tensions between the US and China, and at the same time gave an assessment of the impact on the global economy and financial markets in general. Vietnam in particular.

Developments in escalating US-China trade tensions

US-China trade tensions have been unpredictable with increasing levels since March 2018. On August 23, 2019, trade tensions between the two countries were pushed to a new level when the two sides announced that they would impose higher tariffs to retaliate against each other; accordingly, China announced that it would impose tariffs of 5 or 10% on $75 billion of US goods (effective from September 1 and December 15, 2019). In addition, for the two main US exports, automobiles and auto parts, China will impose additional tariffs of 25% and 5%, respectively, from December 15, 2019.

Immediately, President D. Trump announced that he would raise the tariff to 30% (instead of the current 25%) on $250 billion of Chinese goods (effective October 1, 2019) and would impose a 15% tariff on $300 billion per hourthe rest from China from September 1, 2019 (instead of the 10% as previously planned; including some items will be subject to tariffs from December 15, 2019); At the same time, the United States also announced plans to withdraw American businesses from China.

Thus, if nothing changes, almost all imports and exports of the two countries will be subject to higher tariffs, with the farthest date being December 15, 2019. At the same time, President D. Trump also declared that "there is no need for China", including asking American businesses to find alternatives to Chinese goods, showing a very tough attitude of the US side. On the contrary, China also declared that it would not give in and fight to the end. However, on the morning of August 26, 2019, the Truong Quoc Government also softened its tone and declared its readiness to negotiate. However, the development is very unpredictable and may spread to other fields such as technology, rare earth, finance, etc.

Impact on the global economy and Vietnam

International organizations (such as the IMF, WB,...) have warned that US-China trade tensions are slowing down the economic growth of the world, China and the US and may decline sharply. Meanwhile, other economies are "stuck" in this war because both are important economic partners of many countries.

According to Oxford Economics, the world economic growth rate may decrease by 0.5 percentage points, that of the United States will decrease by 0.5 percentage points and that of China will decrease by about 1.3 percentage points in 2020. Most recently, Citibank's research department also assessed that in the next two years, the above-mentioned tariff policy could reduce China's growth by 1-1.8 percentage points; of the United States decreased by about 0.1-0.4 percentage points and the world economy decreased by about 0.2-0.8 percentage points. However, with the new developments from August 23, it is not possible to fully assess the impacts of this war. In addition, trade tensions between the two countries also have a negative impact on investment, disrupting supply chains if the US withdraws businesses from China and China retaliates with a number of other tools such as further tariffs on goods imported from The rest of the United States, restricting rare earth exports to the United States, reducing petroleum imports from the United States, etc.

For Vietnam's economy: as the authors anticipated in the May 2019 report on this topic, in the short term, Vietnam's exports will be negatively impacted, mainly due to declining demand, due to China's promotion of consumption and more protection of the domestic market, and the shift of investment requires time. In fact, Vietnam's export turnover in the first 7 months of 2019 only increased by 7.5% (compared to an increase of 15.3% in the same period in 2018).

In the long term, Vietnam's exports will be more positive when partners look for alternative goods and new production facilities after shifting investment to start business and export. For the commodity industry, if Vietnamese enterprises in industries such as computers, electronic products and components, seafood, furniture, furniture, etc . are responsive, proactive in information, find advantages to exploit, take advantage of opportunities to rise, occupy market share, increase competitiveness, meet standards, demand and increase export capacity, then we will seize the opportunity better. On the contrary, with the domestic market, industries such as steel, leather and footwear, textiles, agricultural products, electronic goods,... will be under more competitive pressure when these items can move from China to Vietnam to avoid taxes.

In terms of investment, the phenomenon of shifting production investment capital flows from China and Hong Kong to ASEAN and Vietnam has appeared, in which Vietnam is evaluated relatively positively. Along with that, the industrial real estate market will also benefit. In the first 7 months of 2019, there was a remarkable capital movement of Chinese and Hong Kong investors into Vietnam with a total FDI of nearly 7.6 billion USD, 3 times higher than the same period last year. accounting for 19.5% of the proportion of registered FDI capital in Vietnam. However, the issue of "wearing the guise of trade and investment" is and continues to be complicated; requiring Vietnam to be vigilant in preventing, screening and actively increasing absorption.

In addition, US-China trade tensions have been disrupting the global supply chain; causing disruptions and delays in production and business, especially FDI enterprises in many countries participating in the chain, including Vietnam. Citibank's research department said that Vietnam, Taiwan, Thailand and South Korea are quite affected by supply chain risks.

With the above developments, BIDV's group of authors has the same opinion as the opinion of large organizations (such as WB, IMF, ADB, etc.) that Vietnam's economy in 2020 will still grow quite well (6.5-6.6%), but will be lower than in 2019 (6.7-6.8%).

Evil for financial markets

The stock market is always a test of reaction tables. For the US stock market, from the recent rounds of tariffs 5 and 6, the market fell sharply, in the same direction as the Chinese stock market (Figure 1).

Figure 1: Trade tensions and stock market volatility in the US and China

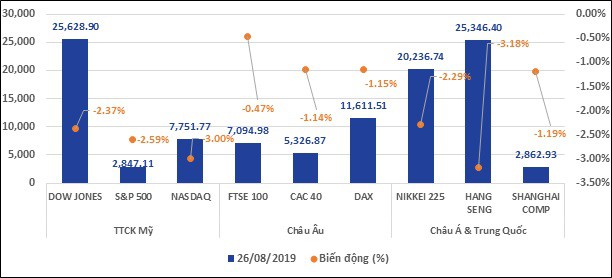

With the sixth round, right after the retaliatory declarations of tariffs, on August 23, 2019, the Dow Jones index fell by more than 2.37%, the S&P 500 fell by 2.59%, and the Nasdaq fell by 3%. Similarly, in the European market, the FTSE 100 index fell 0.47%, the DAX fell 1.15%... Similarly, Asian stock markets in general and Chinese stock markets in particular have reacted negatively. By 12 o'clock on August 26, 2019 (Vietnam time), the Shanghai Composite Index fell by 1.29%, the Hang Seng fell by 3.18%, the Nikkei 225 fell by 2.29%... (Figure 2). Particularly, Vietnam's VNindex decreased slightly (0.96%), maybe investors felt the impact somewhat less, etc.

Figure 2: Fluctuations of some stock markets on 26/8/2019 (points, %)

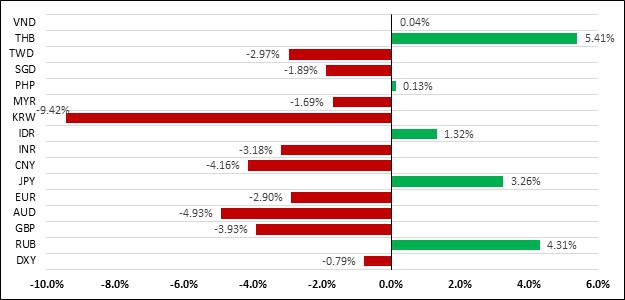

Regarding the exchange rate, US-China trade tensions have a strong impact on the exchange rates of most countries. From the beginning of 2019 until now, the downward trend of most currencies against the USD has continued (except for some currencies such as JPY, THB, RUB...); especially the currencies of countries that depend heavily on exports and are assessed to be negatively affected by US-China trade tensions. In that context, the VND is considered relatively stable, with very little fluctuation since the beginning of the year (Figure 3).

Figure 3: Fluctuations of some currencies against the USD from the beginning of the year to August 26, 2019

Through the above evidence and analysis, it can be seen that the escalating trade war has strongly affected the global economy and financial markets; with Vietnam to a lesser extent, but it is still too early to make a full judgment and forecast.

Final Thoughts:

The US-China trade tension has escalated and become more unpredictable, the impact on the world economy and Vietnam is increasing ; requiring policymakers and Vietnamese businesses to always follow along. monitoring, analyzing and forecasting, and coming up with different response scenarios (including worst-case scenarios). For Vietnam, opportunities are there, but there are also many risks and challenges; therefore, it is necessary to actively increase capacity and diversify markets to take advantage of export opportunities, more balanced trade with the US; be vigilant in screening investment projects; resolutely fight fraud in the guise of trade; be alert not to get into currency wars; adjust appropriate foreign exchange market interventions to avoid being considered currency manipulation.

At the same time, Vietnam also needs to focus on increasing the resilience of the Vietnamese economy, by paying attention to accelerating restructuring, harmonizing monetary and fiscal policies, accelerate the handling of bad debts, sharply reduce foreign debts and budget deficits, increase foreign exchange reserves and control investment capital flows, etc.

TS. Can Van Luc and the BIDV Institute of Training and Research Authors/ (Cafef.vn)

Related News

Foxconn pours $1.5 billion into Thanh Hoa to produce for Apple

14/2/2021

We have generated more than $1,200 billion in GDP

11/11/2020

Vietnam's economic growth forecast for the 4th quarter of 2020 and 2021: Will recover in a V-shape, in 2021 it will increase by about 6.5 - 7%

21/10/2020

Standard Chartered: Vietnam's GDP growth forecast of 3% in 2020 and 7.8% in 2021

20/10/2020

Samsung's outstanding moves in Vietnam and other countries in the "year of Covid-19"

20/10/2020

Featured Articles

Miza Group donated 3 billion VND in response to the contest movement "The whole country joins hands to remove temporary houses and dilapidated houses" in Thanh Hoa

7/6/2025

MIZA GROUP ENTERS THE TOP 10 GREEN VIETNAM ESG 2025 THANKS TO THE CIRCULAR ECONOMY DEVELOPMENT STRATEGY

27/6/2025

Miza (MZG) shares are officially listed on UPCoM

12/11/2024