Vietnamese industrial real estate is 'hot' because a series of factories leave China

According to experts, the impact of the trade war and the advantages of construction costs, labor and development prospects of Vietnam have made industrial real estate heat up.

In early 2019, Goertek - Apple's AirPods headphone assembly company in China spent 260 million USD to invest in building a new factory in Que Vo Industrial Park, Nam Son commune, Bac Ninh city. This is one of the moves of this Hong Kong group to avoid strong US tariffs on products made in China.

Not only Goertek, the unpredictable developments of the US-China trade war are causing many foreign companies to go to the Vietnamese market to set up factories. This has brought a new wind to her real estate market enterprises in Vietnam.

The wave of factory relocation to Vietnam

Along with Goertek, large corporations such as Hanwha from South Korea, Yokowo from Japan, Huafu and TCL from China have all been building factories in Vietnam. Hanwha, one of the 500 largest corporations in the world, has inaugurated the Hanwha Aero Engines aircraft parts factory with an area of 9 hectares in Hoa Lac Hi-Tech Park with a total investment of 200 million USD at the end of 2018.

Previously, Yokowo Group also spent 18 million USD for its 3.6-hectare factory in Dong Van II industrial park (Ha Nam).

TCL is one of the major Chinese corporations that relocated its factory to Vietnam to avoid tariffs.

Even Chinese companies themselves feel uneasy about the war between the world's two largest economies with domestic production line systems.

TCL quickly chose a 7.3-hectare plot of land to house its $53.56 million TV factory in Binh Duong earlier this year. Meanwhile, garment giant Huafu also spent $362 million to build a factory in Long An to access cheaper raw materials, reduce labor costs as well as avoid tariff barriers.

The move of TCL and Huafu shows that not only multinational companies are worried about excessive tax rates, domestic companies are also forced to find a way to "exit" for themselves.

According to VinaCapital, some big names in the electronics and apparel industry such as Foxconn, Lenovo, Sharp, Asics, Nintendo, Kyocera are also considering moving their factories to Vietnam.

Fastest Growing Market in Southeast Asia 2019

Records by the Asian Development Bank (ADB) show that Vietnam maintained its position as the fastest growing economy in Southeast Asia in 2019 with a GDP growth rate of 6.8%. While this figure in Indonesia is 5.8%, Malaysia is 4.5%, Thailand is 3.5% and Singapore is 2.4%.

Shipments from the U.S. to Vietnam are on the rise as many companies seek to avoid tariffs on Chinese products. Photo: Reuters.

At the same time, in 2018, the World Bank also assessed Vietnam to rank 69th out of 190 economies that are easy to do business in, higher than Thailand, Malaysia and Singapore.

Besides, factors such as abundant labor resources at affordable prices and lower factory construction costs than other countries in the region make businesses more interested in building manufacturing plants in Vietnam.

According to Trading Economics, the average wage in the manufacturing industry in Vietnam is 237 USD/month, while this figure in Malaysia, China and Thailand is 924 USD, 866 USD and 412 USD, respectively. In July 2019, Vietnam's PMI was 52.6, industrial production growth was 9.6%, higher than other major economies in the region.

In the first 3 months of 2019, the U.S. Census Bureau said that the US continued to be Vietnam's largest import market with 40.2%.

Industrial real estate develops thanks to FDI investment

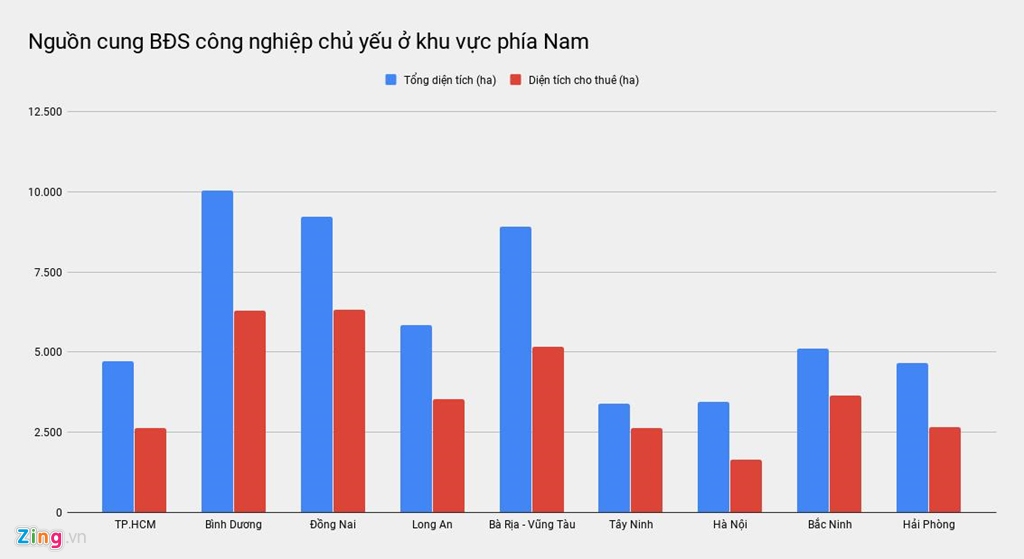

The residential industrial land fund is still quite abundant in Vietnam. Source: Savills Vietnam

Vietnam's industrial real estate segment is growing on the upward momentum of FDI capital 10 times higher during the past decade. The Ministry of Planning and Investment statistics in the first half of 2019, the industry received 1,723 newly registered FDI projects with a total investment of 7.41 billion USD. In which, the manufacturing segment attracted 605 projects, accounting for 71.2% of FDI with 13.15 billion USD, up 39.8% year-on-year. This capital mainly comes from companies from Hong Kong, South Korea and China.

Assessing the industrial real estate market, Mr. John Campbell, Senior Consultant, Industrial Services Department of Savills Vietnam said: "Although the occupancy rate in key provinces has grown strongly year-on-year, the abundant land fund and small projects The increase in U table has boosted the interest of foreign investors in the domestic market."

He also said that manufacturers are paying more attention to the central provinces while investors are also promoting the conversion of agricultural land to industrial land, creating new supply.

Savills' latest research shows that the abundant supply of industrial land is facilitating manufacturing projects and increasing leasing options for both ready-to-lease and on-demand factories.

However, experts assess that before this development, Vietnam needs to be more careful in choosing future projects to grow more in chain value, increase competitiveness and sustainable development.

According to Zing.vn

Related News

Foxconn pours $1.5 billion into Thanh Hoa to produce for Apple

14/2/2021

We have generated more than $1,200 billion in GDP

11/11/2020

Vietnam's economic growth forecast for the 4th quarter of 2020 and 2021: Will recover in a V-shape, in 2021 it will increase by about 6.5 - 7%

21/10/2020

Standard Chartered: Vietnam's GDP growth forecast of 3% in 2020 and 7.8% in 2021

20/10/2020

Samsung's outstanding moves in Vietnam and other countries in the "year of Covid-19"

20/10/2020

Featured Articles

Miza Group donated 3 billion VND in response to the contest movement "The whole country joins hands to remove temporary houses and dilapidated houses" in Thanh Hoa

7/6/2025

MIZA GROUP ENTERS THE TOP 10 GREEN VIETNAM ESG 2025 THANKS TO THE CIRCULAR ECONOMY DEVELOPMENT STRATEGY

27/6/2025

Miza (MZG) shares are officially listed on UPCoM

12/11/2024