Vietnam's paper and pulp market in 2019 and comments for 2020

In the context of complicated world economic and political situations, major economies growing unevenly, the trend of trade protectionism is increasingly evident and widespread, especially the US-China trade war is tense in 2019. The tension has had certain impacts on Vietnam's economy in a positive direction and also many negatives.

2019 – Many bright spots

However, Vietnam's economy is still one of the bright spots in the world. In 2019, Vietnam's GDP increased by 7.02%, exceeding the National Assembly's target of 6.6% to 6.8%. Meanwhile, the total import and export turnover exceeded 500 billion USD for the first time and reached 516 billion USD, with a trade surplus of 9.9 billion USD.

The number of newly registered enterprises was 138,100, 39,400 enterprises resumed operation, 16,000 enterprises ceased operation, of which the total number of employees in newly established enterprises was 1.25 million people. Foreign investment in Vietnam, newly registered capital of 16.7 billion USD, adjusted capital increased by 5.8 billion USD, total value of capital contribution and share purchase reached 15.5 billion USD.

The bright spot of Vietnam's economy is a great driving force for Vietnam's paper market to achieve impressive numbers in 2019; Paper consumption of the whole industry is estimated at 5.432 million tons, up 9.8%; Paper exports reached 1.0 million tons, up 23.6%, imports reached 2.02 million tons, down 2.9% over the same period in 2018. In particular, packaging paper and tissue paper for consumption and export achieved impressive output and growth rate.

However, for printing and writing paper, there are many challenges, production increases but consumption decreases; imported photocopy paper decreased by 18.1%, but uncoated printing and writing paper increased sharply by 20.9%. Imports of printing paper and writing paper from the Chinese and Japanese markets increased. The decline in consumer demand in China into the Vietnamese market has led to an increase in the amount of paper, putting pressure on product prices for domestic enterprises.

Not stopping there, countries such as Indonesia, Thailand, and Japan cannot export to China, South Korea, India, and the United States to other markets, including Vietnam, leading to very fierce competition.

Packaging Paper

Consumption, packaging paper in 2019 is estimated to reach 4.175 million tons, up 12.5% over the same period in 2018, although the consumption growth rate is lower than the same period last year

2018/2017 but in the general context of growth in the world is not as expected, this is a very impressive number.

In which, surface packaging paper (testliner, white top liner) and corrugated layer (medium) are mainly used for the production of cardboard boxes, reaching an output of 3.41 million tons, a growth of 16.0%; coated packaging paper mainly made boxboards, reaching an output of 0.765 million tons, up 9.0% over the same period in 2018.

Exports, in 2019, are estimated to reach an output of 0.801 million tons and a growth of 25%, exports are mainly face layer paper and corrugated layer paper. Vietnam's main export market is in the region, such as China accounting for about 67%, other Asian countries 26%, Africa 2.8%, North America 2.5%, Europe 1.7%.

Imports, in 2019, were estimated at 1.225 million tons, a slight decrease of 0.8% over the same period in 2018. In which, imports of face and corrugated paper reached an output of 0.495 million tons, down 12.9%; coated packaging paper reached an output of 0.730 million tons, up 9.4% over the same period in 2018.

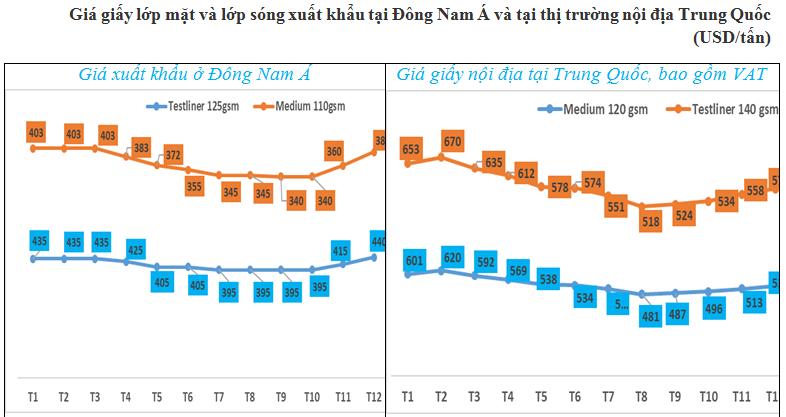

Regarding paper prices in 2019, imported and exported face layer and corrugated layer paper in Southeast Asia: Paper prices began to decrease from March and decreased continuously until October, a total decrease of 40 USD/ton (928,000 VND/ton) for face layer paper; with corrugated paper decreased by 63 USD/ton (1,461 million VND/ton). In October, the price of paper began to go up and now by December 2019, it has increased by 45 USD/ton (1,044 million VND/ton) for both face layer and corrugated layer paper compared to October 2019.

Consumption of printing paper, writing paper, and photocopy paper in 2019 was estimated at 0.719 million tons, down 9.7% over the same period in 2018. In which, printing paper and uncoated writing paper reached 0.531 million tons, down 1.1% (in 2018, consumption was 0.537 million tons); coated printing paper reached 0.188 million tons, down 27.4% over the same period in 2018 (consumption was 0.259 million tons).

Exports, in 2019, the total export volume is estimated at 7,800 tons, down 2.5% over the same period in 2018, the product is uncoated printing and writing paper.

Imports, in 2019, the total import volume reached 0.409 million tons, down 15.67% over the same period (in 2018, imports reached 0.485 million tons). In which, printing, writing and photocopying paper reached 0.221 million tons, down 2.2% (photocopy paper decreased by 18.1% but printing and writing paper increased by 20.9%); coated printing paper reached 0.188 million tons, down 27.4% over the same period in 2018. The market for photocopy paper supply to the Vietnamese market is Thailand 53% and Indonesia 46%, another 1%; For the supply of uncoated printing and writing paper, Indonesia is 48.2%, followed by the Chinese market at 21.1%, followed by Japan at 17.4%, Thailand at 4.7%, and other countries at 8.6%.

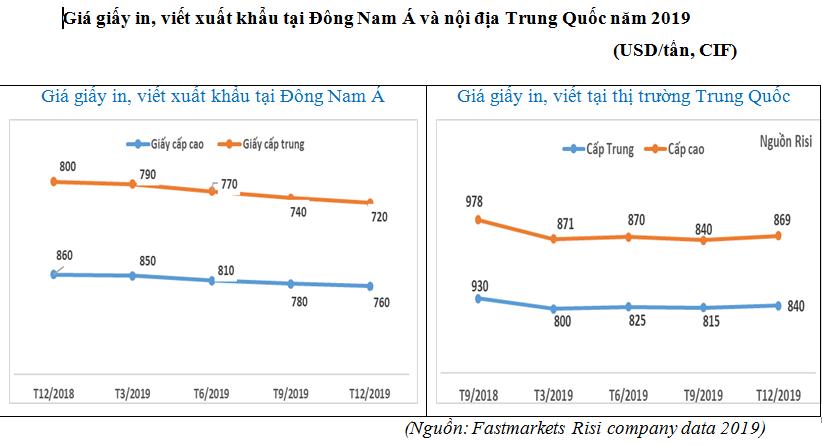

The price of paper in 2019, printing paper and uncoated writing paper exported in the Southeast Asian market in 2019, the price decreased continuously quarter-on-quarter including both high and medium quality, by December 2019 the price was as follows: high-quality paper, priced at 750 USD/ton and down 100 USD/ton (2.32 million VND/ton) compared to January 2019, mid-quality paper mainly produced from recycled pulp priced at 720 USD/ton, down 80 USD/ton (1.85 million VND/ton) compared to January 2019. Meanwhile, paper prices in the Chinese market in 2019: after decreasing at 840 USD/ton in the third quarter of 2019, but the price increased in the fourth quarter of 2019 for both high-end and medium paper at 29 USD/ton (0.628 million VND/ton) and 25 USD/ton (0.580 million VND/ton), respectively, This price increase is mainly due to pressure on environmental, energy, fuel, and labor costs.

Tissue paper

Consumption, tissue paper in 2019 is estimated at 181,000 tons, up 10.4% over the same period in 2018.

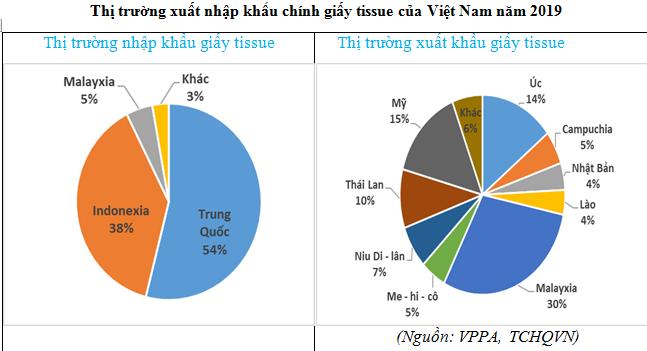

Imports, reached 39,000 tons, up 77.3% over the same period in 2018. The main supply market for tissue paper for Vietnam mainly comes from China and Indonesia, accounting for 54% and 38% respectively, and other countries 8%.

Exports, reaching an output of 67,000 tons, up 19.6% over the same period in 2018. In which, Vietnam's main export markets for tissue paper are Malaysia accounting for 25%, followed by the United States accounting for 15%, Australia 14%, followed by New Zealand 7%, Cambodia 5%, Mekong 5%, Japan and Laos 4%.

Other Paper

Consumption of newsprint paper is estimated at 47,000 tons, down 6% over the same period in 2018. Consumption of votive paper was about 5,500 tons, up 10%, exports reached 125,000 tons, up 19% over the same period in 2018.

Special paper such as carbonus paper, photo printing paper, money printing paper, heat transfer paper, filter paper, decorative paper, cigarette rolling paper, etc. in 2019, consumption reached 301,000 tons, an increase of 3.8% over the same period in 2018.

Pulp price in 2019

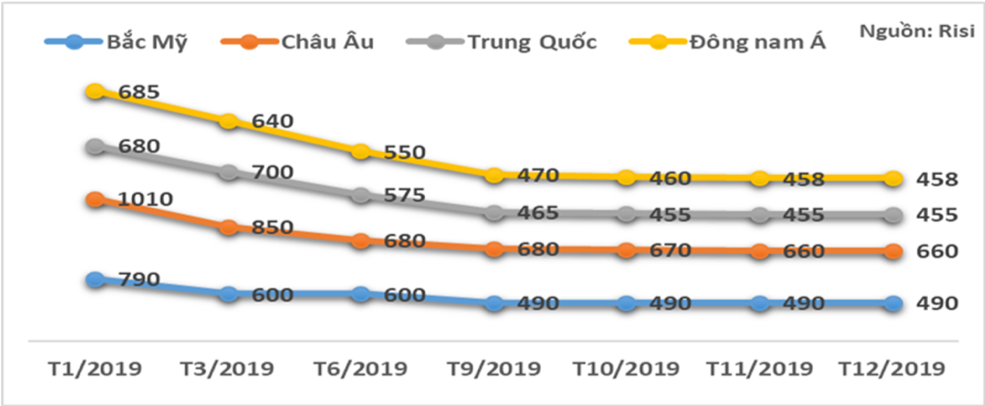

Hardwood bleaching chemical pulp (BHKP) price. Commodities in the world in 2019 fell sharply and continuously in the first, second, and third quarters, then went sideways in the fourth quarter. Price increases and decreases in the regions are as follows: in China, by December 2019, the price was at 455 USD/ton, down 33.0% (225 USD/ton) compared to January 2019; in Southeast Asia: by December 2019, the price was at 458 USD/ton, down 33.1% (227 USD/ton) compared to January 2019; In North America: by December 2019, the price was at 490 USD/ton, down 38% (300 USD/ton) compared to January 2019; in Europe: by December 2019, the price was at 660 USD/ton and down 34.6% (350 USD/ton) compared to January 2019.

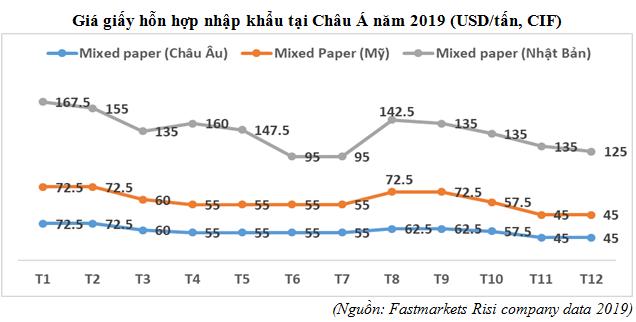

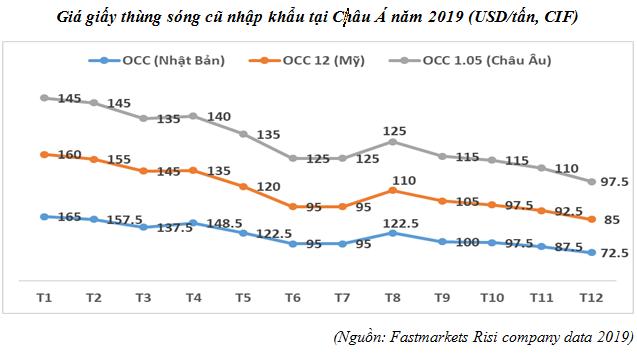

Import recall paper price in 2019

The price of mixed paper from the US, Europe, and Japan in 2019, fluctuates erratically and continuously. In which, mixed paper from Japan to December 2019 was priced at 125 USD/ton and decreased by 42.5 USD/ton (0.986 million VND/ton), from the US and Europe at 45 USD per ton and decreased by 27.5 USD/ton (0.638 million VND/ton).

The price of old corrugated carton paper (OCC), from Japan, the US and Europe, also fluctuates up and down very erratically and continuously. In which, OCC 12 from the US to December 2019 was at the price of 85 USD/ton, down 75 USD/ton (1.74 million VND/ton); for OCC 1.05 from Europe to December 2019 at the price of 97.5 USD/ton, down 47.5 USD/ton (1.10 million VND/ton); while OCC from Japan to December 2019 was at the price of 72.5 USD/ton, down 92.5 USD/ton (2.14 million VND/ton).

How will the paper market in 2020 develop?

In the context that the world economy still has many potential risks, political tensions are still unpredictable and complicated, but based on internal and external factors. VPPA makes some comments for the paper market in 2020 to help P enterprises grasp the situation to serve the production and business plan with the best efficiency.

Paper packaging – opportunities and challenges

In 2020, domestic packaging paper has many opportunities for development. Typically, in terms of consumption, domestic packaging paper is forecast to grow by over 11%. The key factors leading to the positive outlook for the growth of packaging paper in the Vietnamese market in 2020 are based on the following factors:

First, packaging paper has been proven to be directly proportional to GDP growth, while Vietnam's GDP in 2020 is forecast to grow by about 6.8%.

Secondly, the export target is 300 billion USD, of which the industries using a lot of paper packaging have a high growth rate of over 10% in 2020, such as agricultural goods, forestry and fisheries; group of processed industrial goods (textiles and garments; leather and footwear), wooden furniture; phones of all kinds and components; computers, electronic products and components, means of transport and spare parts, electrical wires...

Third, the shift of businesses from China, Hong Kong, Taiwan, and Japan to export paper packaging due to the challenge of the US tariff rate of 25% for China.

Fourth, domestic retail consumption increased by over 11%.

Fifth, policies to encourage FDI enterprises to increase the localization rate and product origin policies can be issued in 2020.

Sixth, limiting plastic waste and encouraging the use of alternative paper packaging are showing signs of strong development.

In addition, the consumption of packaging paper in the world and Asia is forecast to grow by 2.9% and 3.8%, respectively, which may also grow more than forecast: the restriction of plastic waste and the promotion of the use of paper packaging The world is spreading and growing, especially in major economies.

Exports of packaging paper and paper packaging to the Chinese market in 2020 are expected to be higher than in 2019. China forecasts a shortage of more than 2 million tons of packaging paper and may be higher if the recalled paper quota drops sharply, higher paper prices due to rising raw material price pressures and environmental costs, labor, energy.

Exporting paper packaging and paper packaging has many opportunities to enter the market with tax incentives from the new trade agreements CPTPP, Vietnam – EU and in-depth and comprehensive development agreements.

In addition to the above opportunities, Vietnam's paper industry also faces many challenges. Domestic consumption faces many fierce competition challenges: from domestic manufacturing enterprises, when production in 2020 is expected to increase by about 350,000 tons, while the new capacity in 2018 – 2019 is only about 70%.

Fierce competition with imported paper: In Asia (excluding China), Risi forecasts an oversupply of 0.5 million tons for 2020. Imported paper is expected to arrive stronger from countries in new agreements, especially the EU region when it forecasts a large oversupply (in 2020 new capacity of 3.4 million tons)

Exports to China compete fiercely with many countries: China has reduced the import tax on corrugated paper to 5% in 2020 for many countries (previously over 7% depending on the country), while this 5% tariff was previously only preferential for some countries ASEAN.

Printing paper, uncoated writing paper

Domestic consumption is expected to grow very strongly because of the five key factors leading to the growth of printing, writing and photocopying paper in 2020. First, the movement of about 10 FDI enterprises from China in processing notebooks, books, and export forms and there have been a number of enterprises engaged in production and export activities. Second, the opportunity to expand the export of notebooks and notebooks into the new tax incentive market CPTPP and EU. Third, opportunities for Vietnamese businesses to increase exports of notebooks and books to the US market (the US imposes a tax rate of 25% on products from China). Fourth, the number of students in the 2019-2020 school year increased by more than 0.5 million. Fifth, the Government's target of 1 million businesses by 2020.

Domestic production has reached a critical level compared to the current capacity: Production has only increased slightly by An Hoa Paper Company, while small businesses have reached the critical level of production, due to old technology lines, outdated, perennial and mainly originating from China.

Pulp prices tend to rise again: Risi forecasts that supply will not meet the demand of 0.7 million tons for 2020.

Besides the above opportunities, there are also challenges for printing paper and uncoated writing paper. Specifically, consumption decreased in the world, Risi forecast a decrease of 0.6% for 2020. Exports of printing and writing paper are fiercely competitive, it is expected that in Asia there will be a surplus of 0.5 million tons in 2020.

Sharp increase in imports to Vietnam: The decline in consumer demand in China will lead to a sharp increase in the amount of paper entering the Vietnamese market, countries such as Indonesia, Thailand, and Japan cannot export to China, South Korea, the US, and India are looking to other markets, including Vietnam.

Imports of notebooks and notebooks are likely to increase sharply: China cannot export notebooks, notebooks and forms to the US due to the tariff rate of 25%, so it is likely to turn to other countries including Vietnam and create a lot of pressure for domestic paper enterprises.

Tissue paper

In terms of opportunities, consumption is forecast to grow by over 10%: Key factors leading to tissue paper growth for 2020.

First, the growth of the service industry, GDP per capita, population, and accommodation. Secondly, it is the shift of FDI enterprises from China (the US imposes an import tax rate of 25%) to Vietnam to process exports to the US, according to Risi statistics, in 2018 China exported nearly 0.367 million tons of tissue paper to the US. Third, opportunities for enterprises producing finished products to export to the CPTPP and EU markets.

Increased exports to the US market partially replace China and other countries: According to data from Risi in 2018, the US imported tissue paper reached 0.451 million tons, in 2019 it was estimated at 0.6 million tons, while in 2020 it is expected to have a shortage of about 18,000 tons.

Exporting tissue paper to the new tax incentive market CPTPP, EU: According to Risi's forecast in the European region in 2020, the supply will not meet the demand of about 95,000 tons.

The first challenge must be said to be fierce competition with tissue paper and finished products imported from China and Indonesia: China that cannot export to the US will turn to export to Vietnam, in 2020, it is expected that the surplus supply will be 0.410 million tons. Meanwhile, at the end of 2019, Indonesia's new capacity was about 0.2 million tons.

Therefore, with the picture of price fluctuations in 2019, the comments from the perspective of opportunities and challenges of paper, the Editorial Board of Paper Industry hopes that businesses will make the right decisions for the unit to develop more and more. prosperous.

VPPA (Extract from Paper Industry Publication No. 1/2020)

Related News

Foxconn pours $1.5 billion into Thanh Hoa to produce for Apple

14/2/2021

We have generated more than $1,200 billion in GDP

11/11/2020

Vietnam's economic growth forecast for the 4th quarter of 2020 and 2021: Will recover in a V-shape, in 2021 it will increase by about 6.5 - 7%

21/10/2020

Standard Chartered: Vietnam's GDP growth forecast of 3% in 2020 and 7.8% in 2021

20/10/2020

Samsung's outstanding moves in Vietnam and other countries in the "year of Covid-19"

20/10/2020

Featured Articles

Miza Group donated 3 billion VND in response to the contest movement "The whole country joins hands to remove temporary houses and dilapidated houses" in Thanh Hoa

7/6/2025

MIZA GROUP ENTERS THE TOP 10 GREEN VIETNAM ESG 2025 THANKS TO THE CIRCULAR ECONOMY DEVELOPMENT STRATEGY

27/6/2025

Miza (MZG) shares are officially listed on UPCoM

12/11/2024