Miza Receives Certificate of Existing Issuance

Miza Joint Stock Company (stock code: MZG) officially received the Certificate of registration for public offering, increasing capital by more than VND 105 billion: A strategic step in financial restructuring

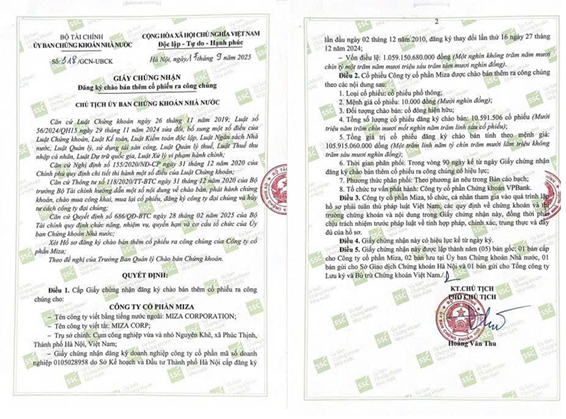

On September 17, 2025, the State Securities Commission issued Certificate No. 318/GCN-UBCK to Miza Joint Stock Company, allowing Miza to conduct an additional public offering of shares in accordance with the law. This is an important milestone, affirming Miza's transparency and compliance in corporate governance and capital raising.

Miza Joint Stock Company (stock code: MZG) has just announced a plan to offer to the public more than 10.59 million ordinary shares at a price of 10,000 VND/share. The total value of mobilized capital is estimated at VND 105.9 billion, all shares will be offered for sale to existing shareholders by the method of exercising rights. According to the plan, October 1, 2025 is the time to close the list of shareholders. The time for registration and transfer of the right to buy takes place from 07/10 to 17/10/2025.

All capital raised from the offering will be used by Miza to pay the principal of loans due and ahead of time, thereby reducing the pressure on debt obligations in the short term. At the same time, businesses aim to restructure finance, reduce interest costs and improve financial safety, creating a foundation for more stable and sustainable production and business activities in the coming period.

The successful mobilization of more than VND 105 billion is assessed to have a positive impact on Miza's financial structure. The additional capital helps businesses reduce the debt-to-equity ratio, thereby reducing the risk of leverage. At the same time, the narrowing of due debt obligations not only improves the liquidity coefficient, but also helps Miza increase its ability to expand the space to reallocate capital to strategic investment plans as well as maintain stable business operations in the coming periods.

This issuance opens up the opportunity to increase the proportion of ownership for existing shareholders at an attractive asking price compared to the market price. The improvement of the capital structure and the reduction of interest expense are expected to improve Miza's operating efficiency in the long term, thereby minimizing the risk of dilution and creating a positive foundation for corporate value.

Miza sets a revenue target of about VND 4,800 billion in 2025, profit after tax is planned to be about VND 90 billion. At the end of the first half of 2025, Miza recorded net revenue of VND 2,314.5 billion, up 13.89% over the same period, equivalent to completing about 48.2% of the annual revenue plan. The highlight came from profit after tax of VND 47.6 billion, up 192.4% over the same period and completing 52.8% of the profit target for the whole year of 2025.

The capital increase not only helps Miza relieve debt pressure in the short term, but also helps businesses reduce interest costs, thereby improving net profit margins and creating room to accumulate cash flow for long-term investment. This is an important foundation to help Miza maintain stable profitability, improve resilience to fluctuations in the raw material market and interest rates. Especially when line No. 5 (PM5) comes into operation, it will increase the total capacity of packaging paper to more than 300,000 tons/year, creating a clear competitive advantage in the domestic and regional high-quality recycled paper market, thereby strengthening Miza's position in the industry.

With this Certificate, Miza once again affirms its commitment to sustainable development, transparency and accompanying the interests of shareholders and investors. This is an important step in Miza's roadmap towards listing on HOSE in early 2026, in line with the Company's strategic vision and aspirations to reach out to the region.

Related News

FiinRatings issues SPO for Miza Nghi Son's Green Finance Framework

23/1/2026

MIZA WAS HONORED AS "PIONEER IN SUSTAINABLE RESOURCE MANAGEMENT" AT VIETNAM ESG AWARDS 2025

23/12/2025

UOB Green Credit - Creating breakthrough momentum for MZG

27/11/2025

.jpg)

MIZA PIONEERS IN PROVIDING COMPREHENSIVE EPR SOLUTIONS FOR BUSINESSES

5/11/2025

MIZA NGHI SON IS RECOGNIZED AS AN ENTERPRISE THAT VOLUNTARILY COMPLIES WITH CUSTOMS LAWS

3/11/2025

Featured Articles

Miza Group donated 3 billion VND in response to the contest movement "The whole country joins hands to remove temporary houses and dilapidated houses" in Thanh Hoa

7/6/2025

MIZA GROUP ENTERS THE TOP 10 GREEN VIETNAM ESG 2025 THANKS TO THE CIRCULAR ECONOMY DEVELOPMENT STRATEGY

27/6/2025

Miza (MZG) shares are officially listed on UPCoM

12/11/2024